As we navigate the closing months of 2024, a few key market trends are shaping up that impact both buyers and sellers. From interest rates to inventory, here’s a look at the current state of real estate and how these shifts may affect your next move.

Interest Rates and the Fed’s Influence

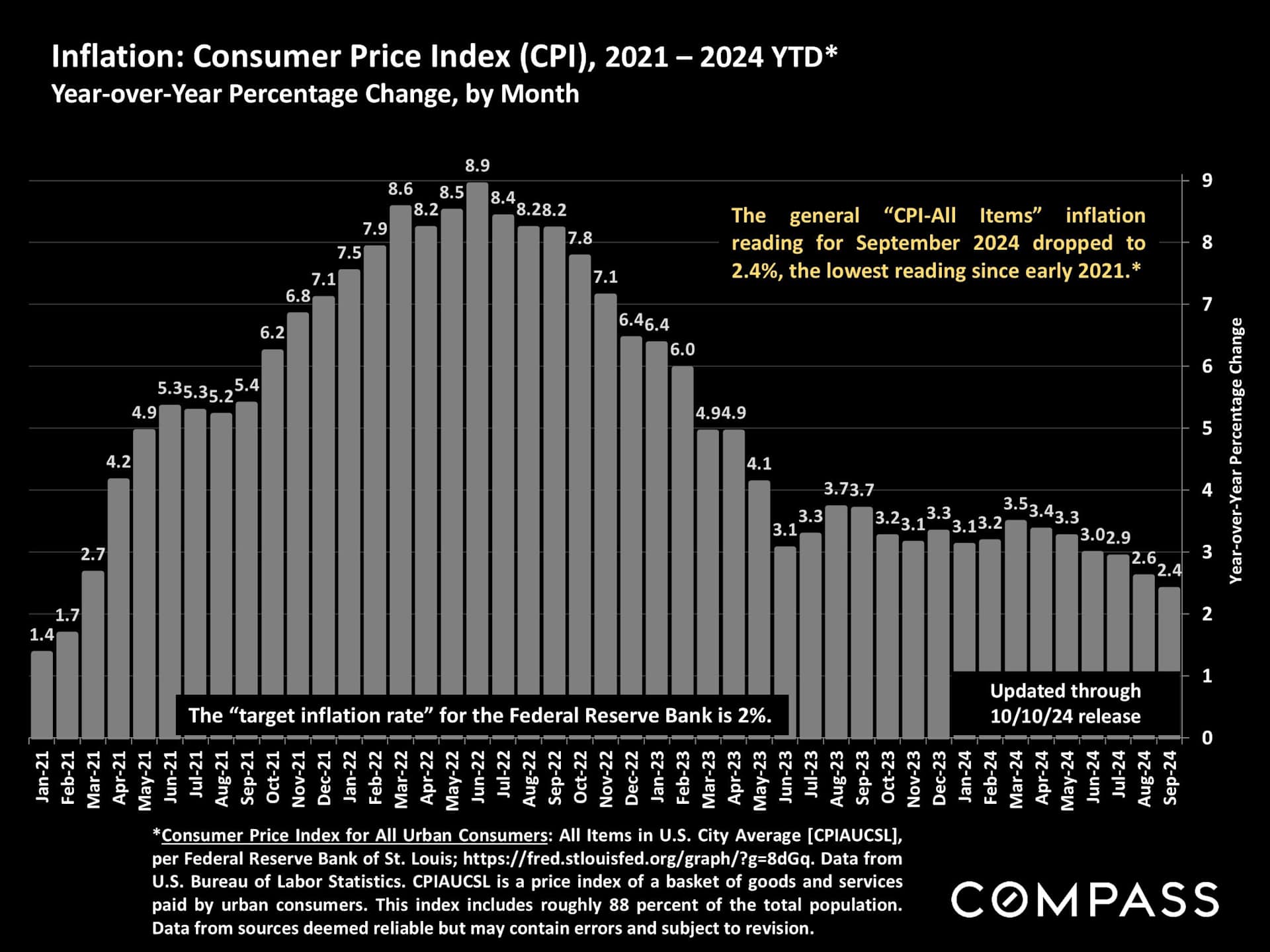

Interest rates experienced a sharp drop in late summer, with many analysts predicting continued decline. However, early October brought a strong jobs report, causing a temporary increase in rates—though still significantly lower than spring levels. Lowering inflation, nearing the Federal Reserve's 2% target, boosts the chances of further rate reductions in coming months, which could ease mortgage rates for prospective buyers. However, with economic indicators fluctuating, it’s best to stay flexible and plan for some volatility.

Economic Confidence and Household Wealth

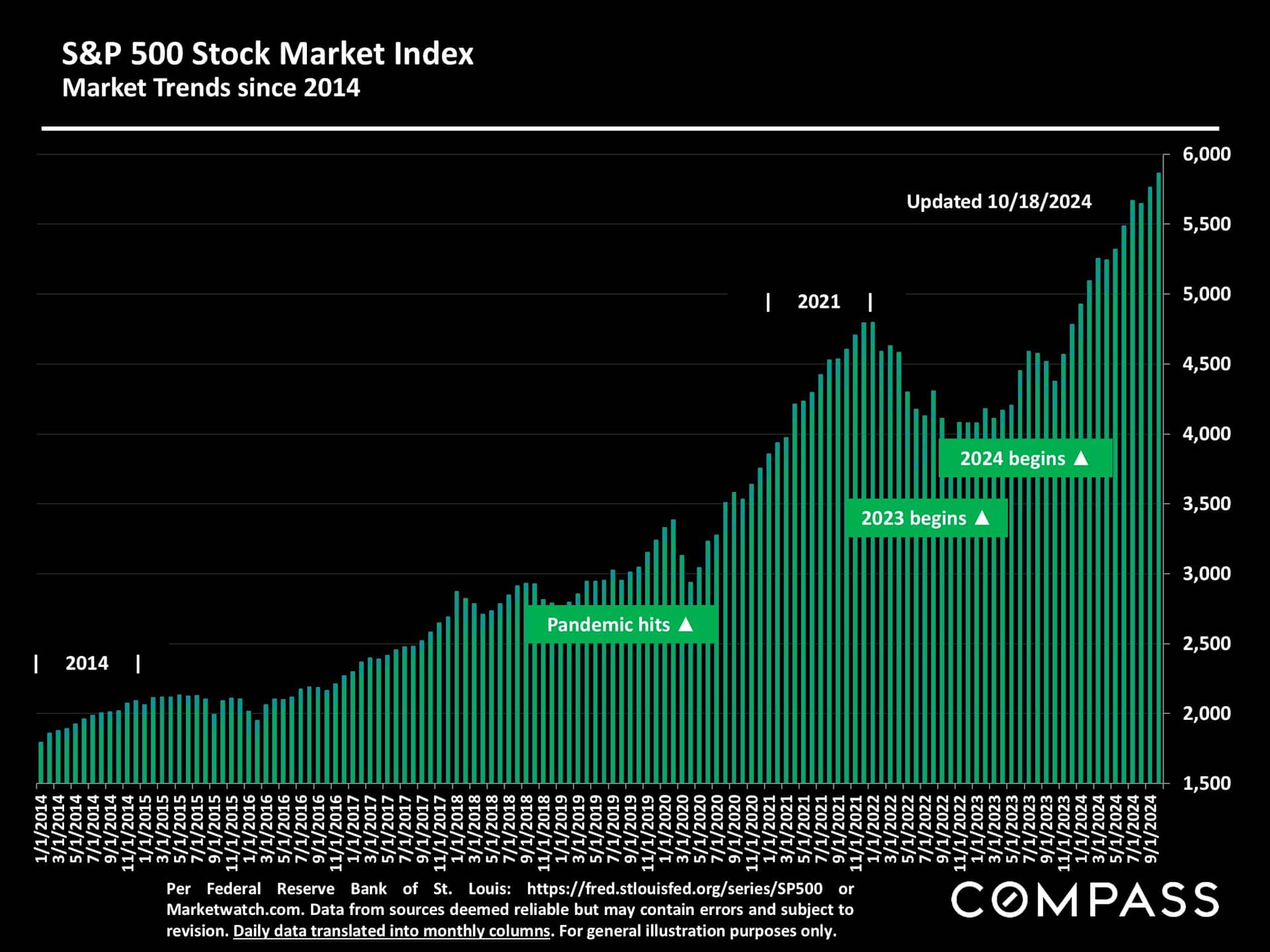

The recent highs in the S&P 500, Dow, and near-record NASDAQ levels have bolstered household wealth, particularly for affluent households. This uptick boosts economic confidence and often encourages both buying and selling activity. A robust stock market also has a ripple effect on luxury home sales, as some may look to reinvest gains into real estate.

Market Inventory: New Listings vs. Sales

The number of new listings has rebounded, altering dynamics in many markets. While more homes are coming to market, sales have slowed, especially since the seasonal peak in late spring. This combination has driven active inventory to its highest level in four years. Though higher than in 2023, today’s inventory still remains below historic norms.

This shift benefits buyers, as they now have more choices and, in some cases, greater negotiating power. However, the market remains competitive: despite a decrease in the pending-sale ratio, it’s still relatively strong by pre-pandemic standards.

Home Prices and Market Trends

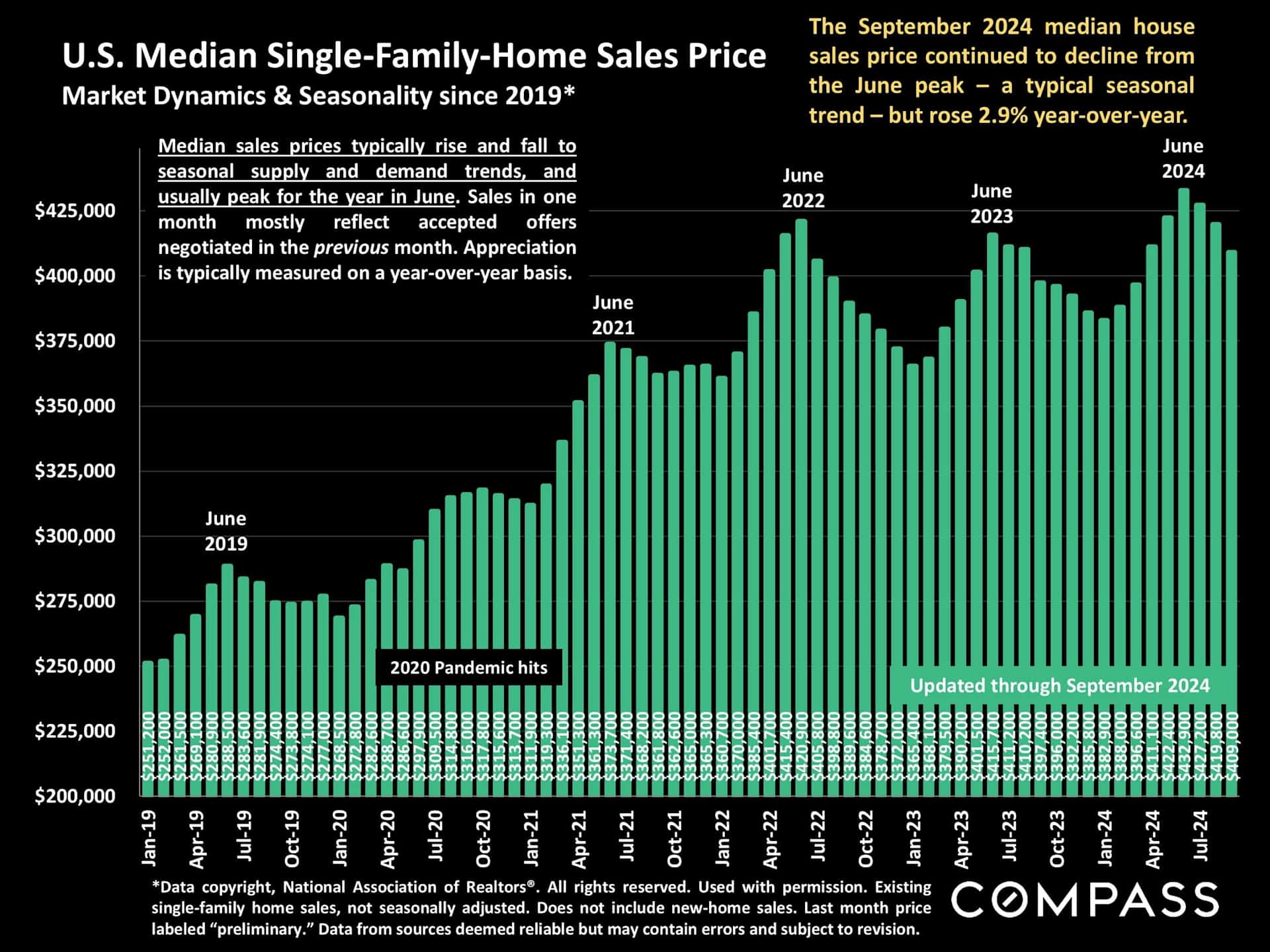

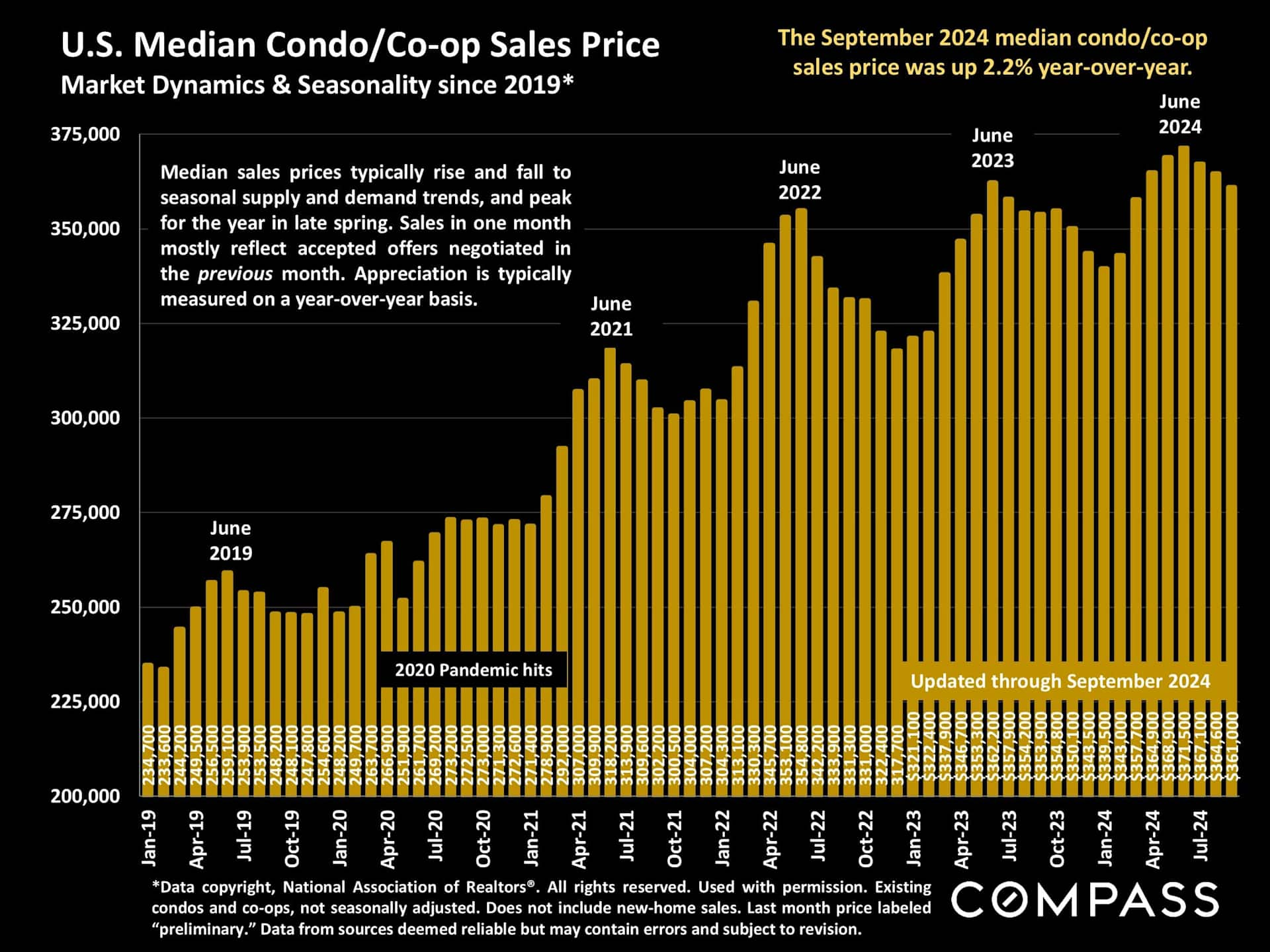

Nationally, the median home price has seen remarkable growth, increasing nearly 49% over the last five years. While seasonal pricing fluctuations are common, the long-term appreciation trend is evident. Similarly, condo and co-op sales prices have appreciated in many urban markets, reflecting ongoing demand. For sellers, the sustained price growth translates into potentially high returns, especially if you purchased your property several years ago.

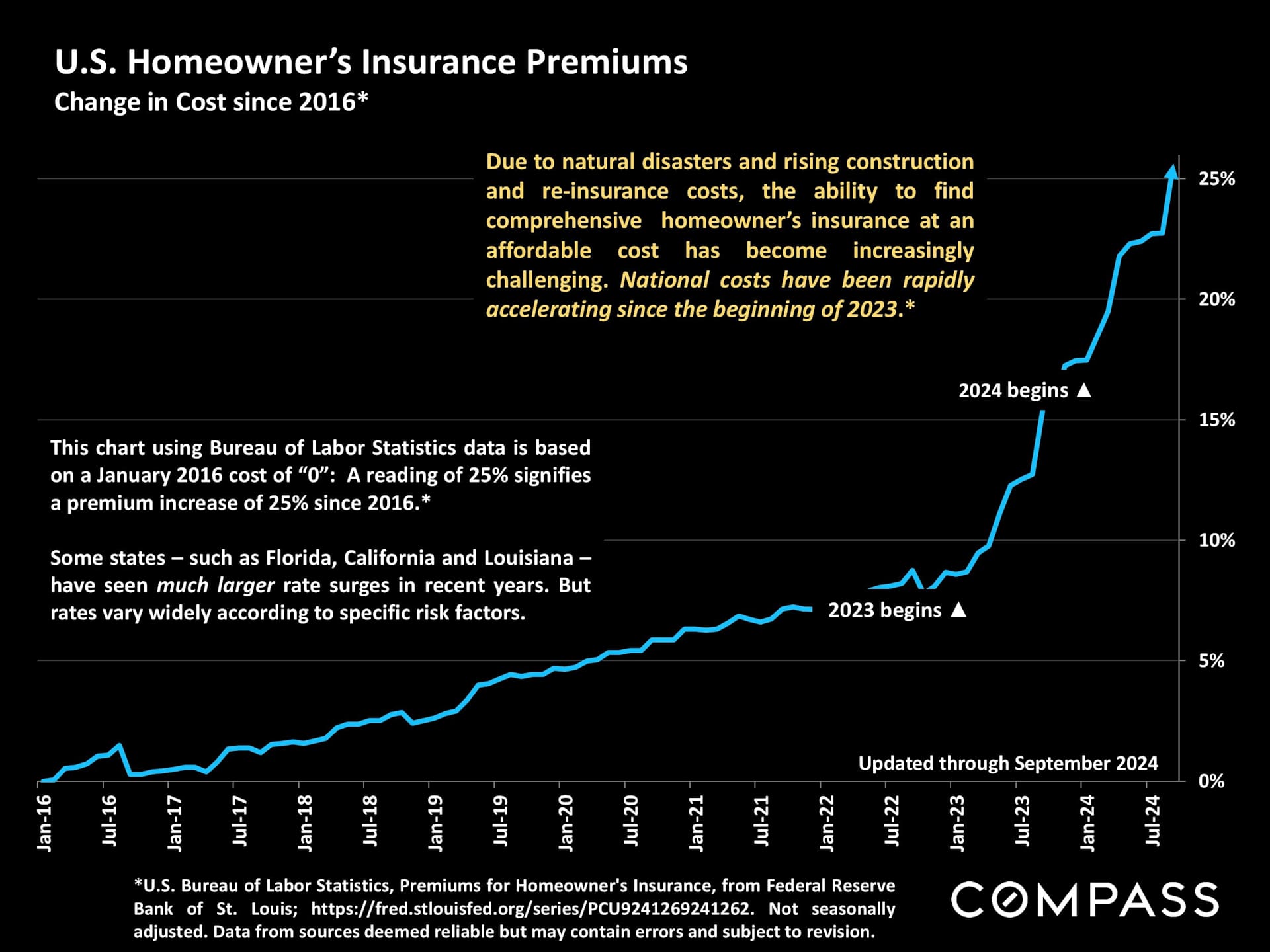

The Growing Insurance Challenge

Increased weather-related disasters have driven up homeowner insurance premiums, particularly in regions prone to extreme weather events. In some states, it’s now challenging to find comprehensive, affordable insurance. Rising costs and limited coverage options are vital considerations for prospective buyers, especially if purchasing in regions affected by hurricanes, wildfires, or floods.

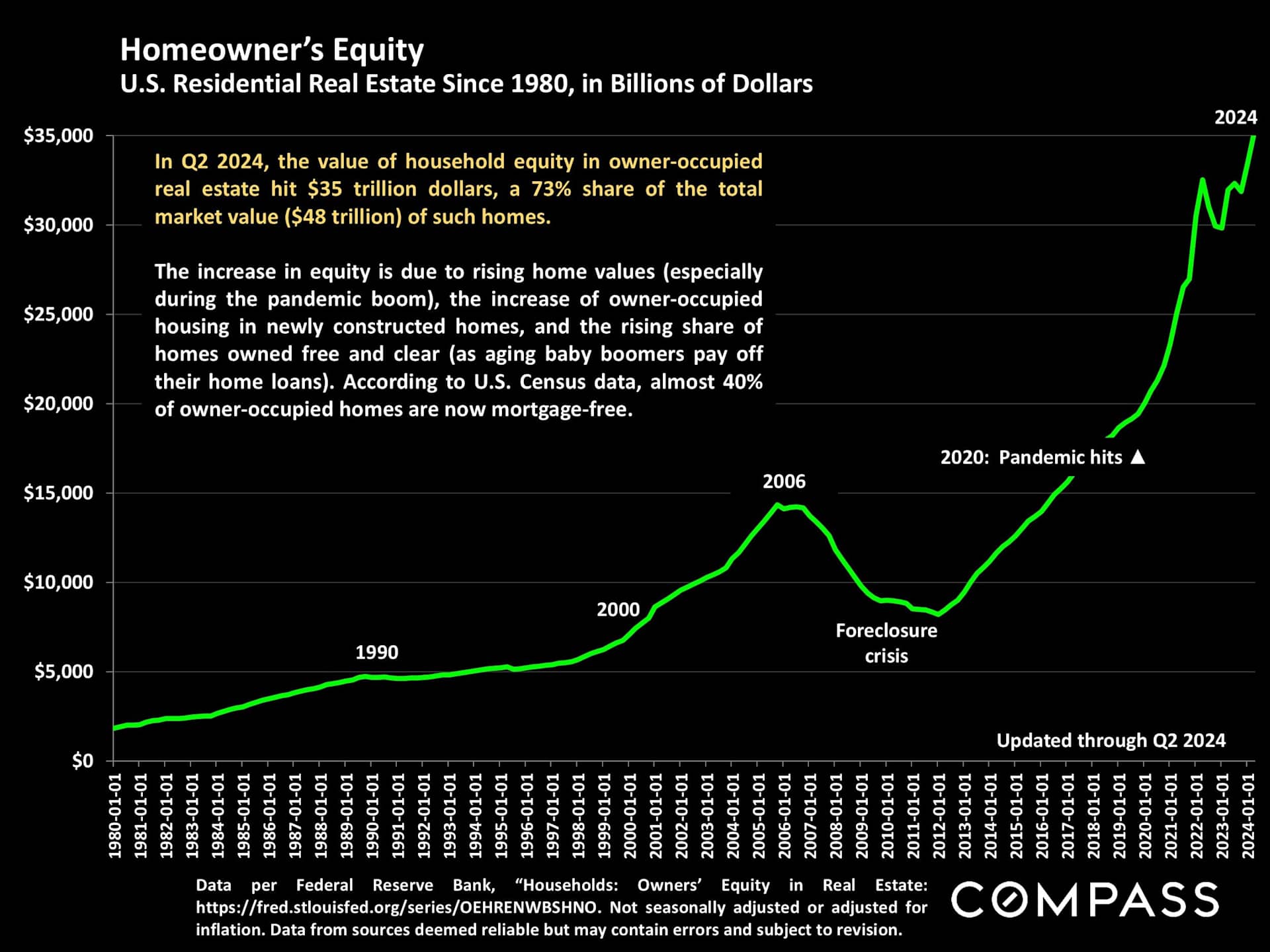

Wealth Growth and Equity

Homeowner equity has soared in recent years, driven by price appreciation, a surge in all-cash purchases, and regular mortgage pay-downs. This trend has given homeowners more flexibility, whether looking to sell, buy a new property, or leverage their equity for other investments.

Final Thoughts

In today’s market, staying informed is essential, whether you're buying or selling. While recent changes may create a more balanced market, local conditions can vary widely. Working with a real estate professional who understands these dynamics can help you navigate opportunities or challenges based on your unique goals.

Please feel free to reach out to Camille at (773) 377-9200 if you or someone you know could benefit from insights tailored to your area or personal situation. Let’s connect and ensure you’re equipped to make the most of today’s evolving real estate market.